Alright, let’s talk about Apple earnings trade . Earnings season – that time when companies unveil their financial performance – is always a bit of a rollercoaster, especially for tech giants like Apple. And if you’re thinking of diving into the world of trading based on Apple’s earnings reports, you’ve come to the right place. This isn’t just about looking at numbers; it’s about understanding the story those numbers tell and how to potentially profit from them. What fascinates me is how much emotion gets wrapped up in these quarterly reports; it’s not just about the cold, hard facts.

Decoding the Apple Earnings Report | What Really Matters

So, you’ve got the earnings report in front of you. Now what? First off, don’t just look at the headline numbers like revenue and profit. Dig deeper! Look at the growth rate compared to previous quarters. Is it slowing down? Is it accelerating? This gives you a sense of the company’s momentum. A common mistake I see people make is focusing solely on whether Apple beat or missed analysts’ expectations. That’s important, sure, but it’s backward-looking.

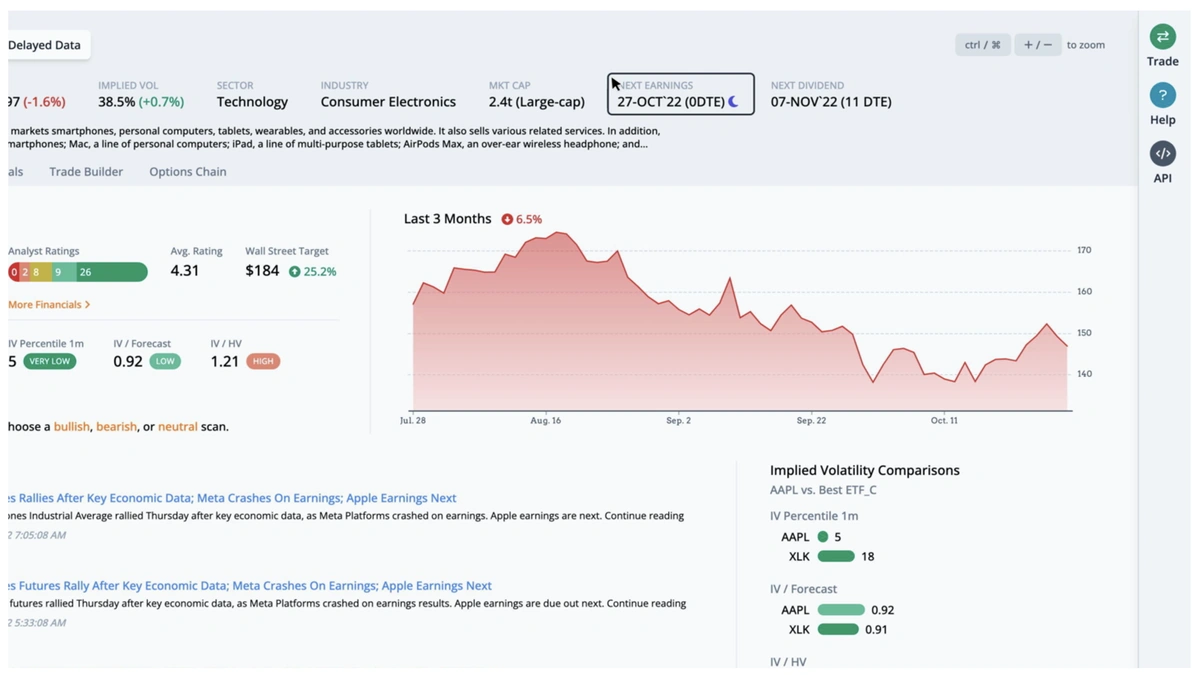

What’s more crucial is the forward guidance – what does Apple expect for the next quarter? This is what really moves the stock. Apple’s management is generally conservative with their estimates, so even a seemingly ‘meh’ forecast can be interpreted positively. The earnings per share (EPS) figure is, of course, vital to watch, as well as Apple’s revenue projections . And it goes without saying that the gross margin is an essential metric to understand the general health of Apple’s business.

But, and this is a big but, the real gold is in the details. Look at product-specific sales. How are iPhones selling? Are services growing as a percentage of revenue? (Services like Apple Music, iCloud, and the App Store are high-margin and increasingly important to Apple’s overall profitability). This gives you insight into where Apple’s growth is coming from. Let me rephrase that for clarity: understanding the sources of revenue growth is key. Also, keep an eye on geographical performance. Is Apple seeing growth in emerging markets like India? This could be a huge long-term tailwind. Let’s be honest, these things take time to show their real impact.

The “Why” Behind the Numbers | Context is King

Okay, you’ve got the numbers. But, why are those numbers what they are? This is where understanding the broader context comes in. What are the macroeconomic trends? For example, are rising interest rates impacting consumer spending on electronics? What about currency fluctuations? A strong dollar can hurt Apple’s international sales.

And what about the competitive landscape? Are competitors like Samsung or Google launching compelling new products that are eating into Apple’s market share? What fascinates me is how Apple navigates these challenges. They’ve built an incredibly sticky ecosystem, but even that can be disrupted. Always factor in what’s happening in the wider world. Also, it’s worth remembering that stock price volatility can be affected by general market conditions and not just Apple’s performance. It is all interlinked.

Consider the overall sentiment around Apple. Is there a lot of hype, or is there a sense of skepticism? This can heavily influence how the stock reacts to earnings news. I initially thought this was straightforward, but then I realized that human psychology plays a massive role. A common mistake I see people make is ignoring the ‘whisper numbers’ – unofficial estimates that circulate among traders before the official release. These can sometimes be more accurate than the official analyst estimates.

Understanding all these variables is an important part of understanding stock valuation and making informed decisions. As per guidelines of trading platforms, it’s essential to stay updated on the latest market trends and be aware of any risks associated with trading.

Strategies for Trading Apple Earnings | A Practical Guide

Now, let’s talk about the fun part: how to potentially trade Apple earnings. There are a few common strategies. The first is the ‘buy the rumor, sell the news’ approach. This involves buying Apple shares before the earnings announcement, hoping for a positive surprise, and then selling them immediately after the announcement to lock in your profits. A common mistake I see people make is holding on for too long, hoping for even bigger gains. Greed can be a powerful enemy. Make sure that you are using the right trading platform and have a solid risk management strategy in place.

Another strategy is to use options. Options give you the right, but not the obligation, to buy or sell Apple shares at a specific price within a certain timeframe. This can be a more leveraged way to play the earnings announcement, but it’s also riskier. If you are not familiar with options, I strongly advise that you seek professional financial advice. As perInvestopedia, understanding thebasics of optionsis critical before you begin. A common mistake I see people make is trading options without fully understanding how they work. Don’t be that person! Before you start trading, you may want to read about market outages .

A third strategy, and perhaps the most conservative, is to simply wait for the dust to settle after the earnings announcement and then make a decision based on the long-term outlook for Apple. This avoids the short-term volatility and allows you to focus on the bigger picture. In any scenario, it’s vital to have a solid investment strategy .

The Emotional Rollercoaster | Staying Calm Under Pressure

Trading Apple earnings can be incredibly emotional. The stock can swing wildly in either direction, and it’s easy to get caught up in the hype or the fear. The one thing you absolutely must do is remain calm and stick to your plan. Don’t let your emotions dictate your decisions.

A common mistake I see people make is revenge trading – trying to make back losses by taking on even more risk. This is a recipe for disaster. It’s crucial to have a pre-defined exit strategy. Know in advance at what price you’re going to sell if the trade goes against you. And equally important, know at what price you’re going to take profits. Don’t get greedy. Remember that any strong quarterly performance does not guarantee future success.

Here’s the thing: Trading is a marathon, not a sprint. There will be winners, and there will be losers. The key is to manage your risk, stay disciplined, and learn from your mistakes. A crucial part of this is accepting that market analysis is not an exact science and nobody gets it right all the time. It’s also worth seeking opinions and tips from those who have significant trading experience .

Frequently Asked Questions

FAQ

What if Apple misses earnings expectations?

The stock will likely decline in the short term. However, it’s important to analyze why they missed. Was it a temporary setback, or is it a sign of deeper problems? If you believe it’s temporary, it could be a buying opportunity.

How important is the conference call?

Very! The conference call, where Apple’s management discusses the results and answers questions from analysts, often provides valuable insights that aren’t apparent in the earnings release itself.

What if I’m new to trading? Should I avoid trading Apple earnings?

Trading earnings is generally considered a higher-risk strategy. If you’re new to trading, it’s probably best to start with simpler strategies and gain more experience before tackling earnings trades.

What are some alternatives to trading before the earnings call?

If the volatility is too risky for you, one thing to do is assess market performance a few weeks or months after the call. Or you can invest in ETFs or index funds that hold Apple in their portfolio.

Can I day trade Apple earnings?

Yes, but be prepared for extreme volatility and rapid price swings. Day trading during earnings season is not for the faint of heart. It takes great skill to time the market in this manner.

Trading Apple earnings can be a potentially profitable, but also a risky endeavor. You must have a comprehensive understanding of the company, the industry, and the broader market. Stay calm, stick to your plan, and always manage your risk. I hope this has helped guide you through understanding how to trade during these volatile times. Good luck, and happy trading!